Former Stanford reliever presents personal finance education through storytelling

“It got picked up by a few accounts… and all of a sudden I went from 500 to 1,500 subscribers, and I was like, ‘Wow, maybe I’m on to something here with the simplification of these. things with little stories and breaking down those concepts in understandable ways, ”Bloom said.

Four months later, it has nearly 33,000 subscribers. He, indeed, could be on to something.

1 / A common thread in the markets

It is the year 1500 and you are entering a market in Renaissance Italy.

There are buyers and there are sellers. The prices of various goods are determined by the interaction by and between these individuals.

Now in the walks Mr. FEDerico, a man of infinite means.

– Sahil Bloom (@SahilBloom) May 9, 2020

Bloom, 29, seven years after throwing ’90s fastballs as the Cardinal’s right-handed reliever, is now vice president of Altamont Capital Partners in Palo Alto, Calif. He graduated in sociology and economics in 2013 and earned a master’s degree in public policy a year later with former Secretary of State Condoleezza Rice as an advisor.

But his passion project is to demystify the world of finance and economics so that Americans of all walks of life can strengthen their financial futures, and he’s carved out his own piece of internet real estate to push that forward. Every Monday, it produces a new Twitter thread featuring an economic topic, a business origin story, or a financial history lesson. They range from how inflation works, to the origins of the Ponzi scheme, to how Sriracha grew into an $ 80 million industry.

In 1980, a Vietnamese refugee arrived in Los Angeles and started making a new spicy sauce.

40 years later, its sauce has grown into a cult following and has grown into an $ 80 million business. His life is the embodiment of the American dream.

Who is up for a story?

– Sahil Bloom (@SahilBloom) September 4, 2020

Each story garnered thousands of likes and retweets. Bloom hopes that providing free access to this information will help people better understand their own finances. He doesn’t believe that financial literacy is dispersed well among those already in the industry, which he hopes to change.

“In the financial world, the status quo is why normal people think they have to pay exorbitant fees to financial advisers to advise on their behalf,” Bloom said. “That’s why my mom asks me if she should pay a financial advisor a percentage in management fees to manage her money for her in index funds.

“This status quo has made a lot of people a lot of money and it’s all because people don’t feel empowered to do these things on their own or learn more about these things.”

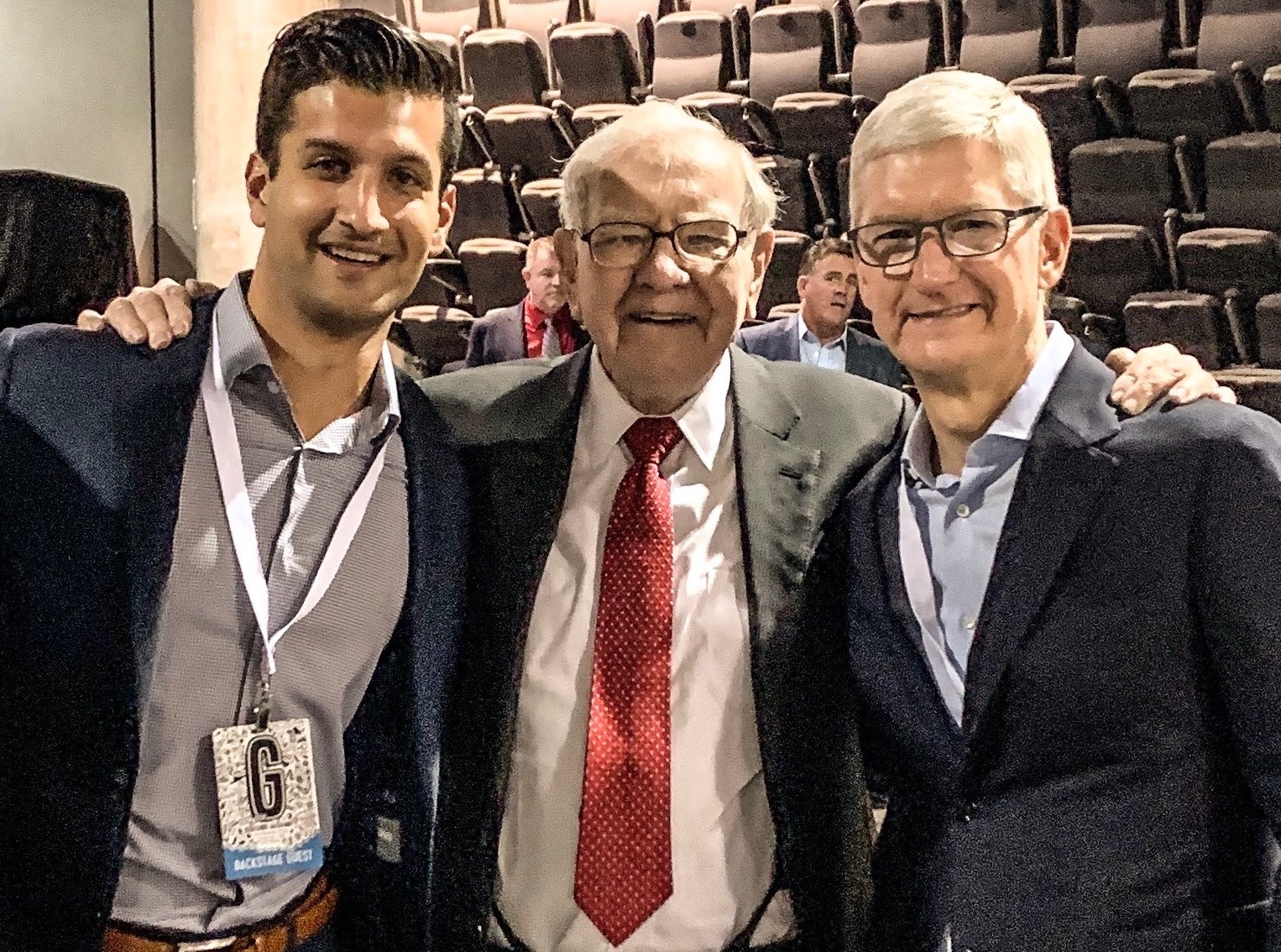

Bloom’s greatest inspirations, ironically, are part of this status quo. He considers Apple CEO Tim Cook to be one of his most important mentors, and the two frequently eat lunch together. They attended receptions with investor Warren Buffett and Reddit co-founder and Serena Williams husband Alexis Ohanian.

Bloom is also inspired by his parents. Her mother, Lakshmi, was born and raised in India and is now an entrepreneur. Her father, David, is a professor of economics and demography in the Department of Global Health and Population at the TH Chan School of Public Health at Harvard.

Bloom hopes to use what he’s learned at home and at Stanford to democratize personal finance education during a time of economic crisis.

As Bloom began to grow his online audience in May, he reached out to Dallas Mavericks owner Mark Cuban, guessing his email. He guessed correctly, and they exchanged emails. They later moved the conversation to Twitter direct messages, and Cuba was impressed with Bloom’s enthusiasm.

Bloom hopes to work with Cuba on personal finance education in the future.

“I was blown away,” Bloom said. “Just for someone like that to take the time to send me a series of DMs, and to be thoughtful and engaging was just amazing to me.

“And it’s clear he’s passionate about these things and about helping people, which is heartening when people in high positions feel that way and want to give back to their community.”

Even Bloom’s former teammates realized he had the potential to make big-scale change.

“He’s a very bright guy and always has been,” said A outfielder Stephen Piscotty, who played with Bloom for three years and considers him one of his closest friends. “He worked really hard. He was always a go-getter.

“I always joke with him that I wait until he runs for president someday. He has a good idea of how the world works.”

Believing that “the talents are evenly distributed, but the opportunities are not,” Bloom advocates putting more personal finance education in schools so that students can learn the basics of money at a young age and create life. wealth early in life.

Her next goal is to write an illustrated children’s book on personal finance.

“Things from the very simple to the slightly more complicated, putting them in ways and in stories that people can really access and really understand at their most basic level,” Bloom said.

So far, he’s only tweeted at a time.

/https://specials-images.forbesimg.com/imageserve/61734788a7ef2d775eb0c7f4/0x0.jpg)